What surprises does Silicon Valley have in store for 2021?

A few bold (and likely incorrect) predictions for the new year

Welcome to Silicon Valley Outsider, a newsletter for aspiring startup founders and investors who live outside the SF Bay Area. Subscribe today to become one of my 140 closest friends:

🗺 What’s going to be the next surprise?

Before I moved to Silicon Valley, I imagined it as a futuristic society where entrepreneurs and investors lived a few years ahead of the rest of the United States. I pictured a virtual reality headset on every hearth, a Tesla in every garage, and a term sheet on every desk. But it turned out that reality was more complicated and more exciting.

Silicon Valley isn’t a place where the one true future plays out a few years ahead of time, it’s a place where all possible futures are being explored simultaneously.

Silicon Valley Insiders aren’t clairvoyants who know if Bitcoin, VR, or GPT-3 will find mass adoption, they’re explorers who are willing to try anything and everything in attempt to discover the next frontier of technology. Silicon Valley’s optimistic, indeterminate futurism is way more exciting than the predestined tech utopia I imagined: surprises trump spoilers every time.

As we look ahead to 2021, there are many potential surprises budding. Some are exciting, some are scary, and any one of them could fundamentally change the future of technology and life as we know it. Here are a few.

📈 How long can the financial markets stay irrational?

2020 has been a remarkable year for the stock market: even though we spent one panicked month from February 21 to March 21 watching our 401k balances plummet, the Dow Jones, S&P 500, and NASDAQ are back all at all-time highs with venture-backed tech companies like Tesla, Snowflake, Palantir, Zoom, and Peloton leading the charge. (Just six venture-backed companies make up more than half of the NASDAQ index.)

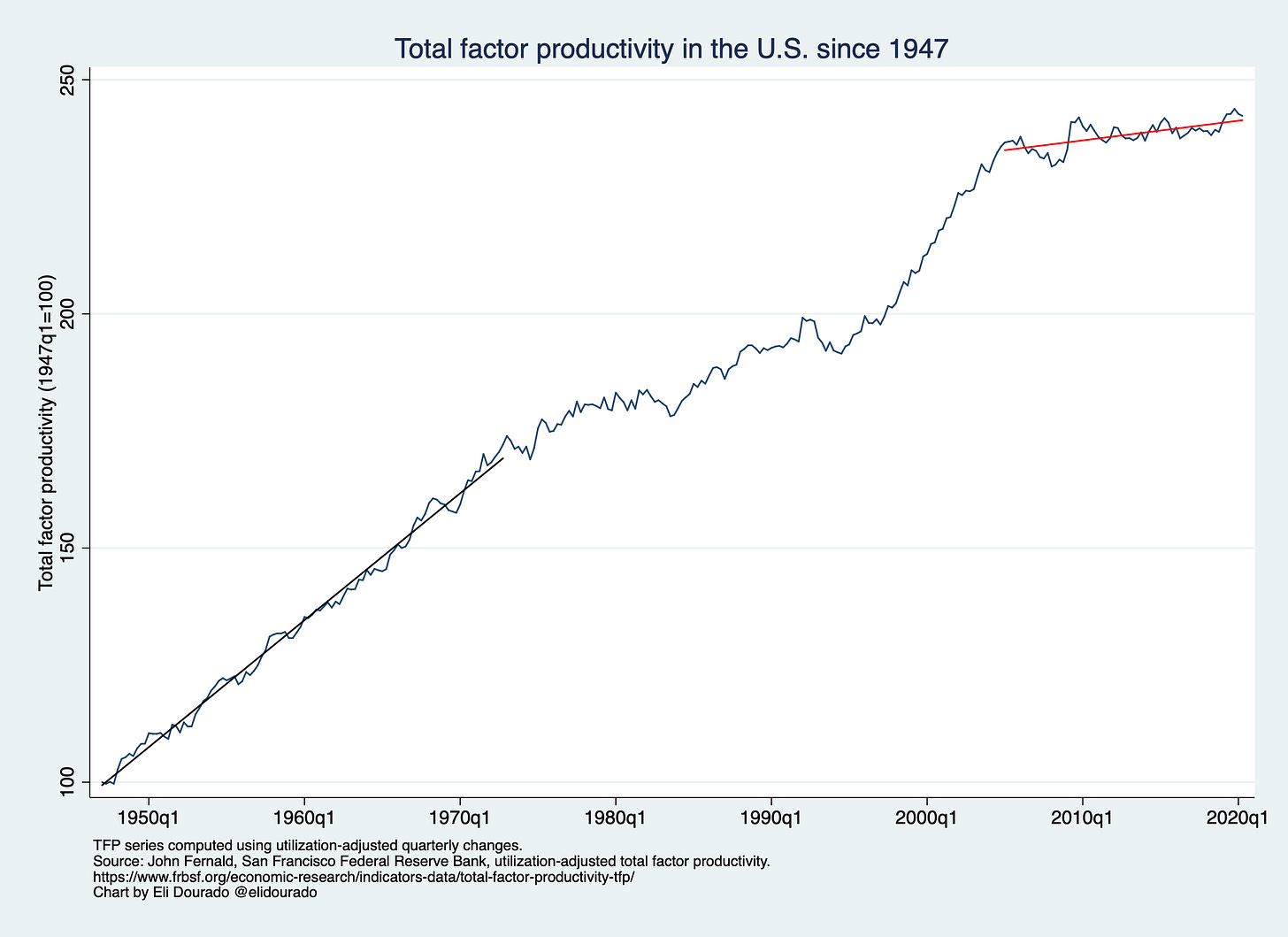

The question, of course, is how long Silicon Valley companies can continue to achieve superlative outcomes while Main Street flounders. Total U.S. employment fell by 20 million in April, instantly wiping out 113 straight months of job growth. Nearly 100,000 small businesses have permanently shut down. And the challenges even extend pre-COVID: modern, tech-loving macroeconomists point to a decade-long stagnation in “Total Factor Productivity,” a metric that basically measures GDP growth per unit of labor/capital input.

Can the crypto-fication of the public equity markets continue, or will tech optimism prove irrational? Will Robinhood continue to buoy “meme stocks,” or will a macroeconomic correction expose it all as a bullish fever dream? Only time will tell — but macroeconomic shifts are certainly one potential surprise in the making.

(My prediction: No crash. Turns out it’s been inflation all along.)

🌏 Where, physically and ideologically, will the next wave of innovation take place?

A second major question for 2021 is how Silicon Valley will react to technological advances that occur beyond its borders.

In 2020, five of the ten largest funding rounds were raised by Chinese startups, and the single largest round was from Reliance Jio, an Indian telecom. (Epic overview by Packy McCormick here, if you’re interested in learning more about Reliance.)

All signs point to an impending, massive, geopolitical, tech-first showdown between the United States and China. Space is likely to be the first frontier — with China successfully landing a probe on the moon in 2020, the space race is back and may buoy (or sink) American tech exceptionalism for decades to come.

And even within the United States, challengers to Silicon Valley’s dominance are real and surging. As I wrote two weeks ago, Silicon Valley still has a massive lead, but other tech hubs are ready to give it a run for its money. Will Silicon Valley’s dominance wane in 2021? Austen Allred, CEO of Lambda School, thinks so:

(My prediction: Silicon Valley will still be a cultural center of gravity, even if remote work survives the COVID vaccine. Also, remote work will probably not survive the COVID vaccine.)

🛠 Is this a new golden era for hard technology?

The talk of the town around the New Year in Silicon Valley is that 2021 is looking like the year of Hard Tech: manufacturing, energy, and biotechnology startups are all the rage.

This is partially due to the Elon Musk Effect: in 2020, SpaceX launched American astronauts from American soil to the International Space Station for the first time since the Space Shuttle’s decommissioning in 2011, and Tesla produced and sold 500,000 cars. Musk’s example alone has investors chomping at the bit to find the next SpaceX or Tesla, and engineers are increasingly interested in working on projects that they believe will directly, tangibly change the world for the better. Your humble author, of course, is working at a satellite company that will triple the internet bandwidth of Alaska in 2021, so I’m far from unbiased — but it’s hard not to think 2021 will be a golden year for hard tech.

Boom, Aerion, and Hermeus are building supersonic aircraft. Skyryse is building autonomous flight systems. Wisk is building VTOL (vertical take-off and landing) flying taxis. Varda is building in-space manufacturing facilities. Relativity is 3D printing rockets. Prometheus is pulling CO2 and water from the air to make zero-net-carbon fuel. Waymo is close to releasing autonomous taxis. Apple’s M1 chips are blowing people’s minds. Similar advances are taking place in everything from lab-grown meat to battery technology; the future is coming fast.

The science-to-hard-technology pipeline is also extremely promising. Researchers are getting closer to achieving quantum data transfer. Moderna, the venture-backed startup that built one of the two coronavirus vaccines, has a cancer vaccine in their pipeline. And DeepMind, Google’s computer program best known for dominating humans in chess and Go, has now used its powers to solve one of the biggest outstanding problems in biology: protein folding.

(My prediction: heck yes, it’s a golden age for hard tech! IT’S TIME TO BUILD!)

🔮 Want to know how it all plays out? Me too!

The best part about the potential surprises above is that they are all fundamentally unpredictable — that’s what makes them surprising!

Over the next year, we’ll explore these three themes — financial market irrationality, Outsider innovation, and state-of-the-art technology — in great detail. If you’d like to stay up to date on the progress Silicon Valley entrepreneurs and investors are making making, subscribe today to make sure you don’t miss out on the fun throughout 2021.

🔌 Shameless Plug: Christian appears on Unstoppable Millennials!

Shoutout to my fellow Renaissance Collective member Michelle Liu, who is building a low-key media empire in Toronto! It was an honor to talk space, entrepreneurship, and business on her podcast.

🧙♂️ Silicon Valley Lore

In this new segment, I’ll share stories that “everyone” knows in Silicon Valley. If you follow along, you’ll pick up Silicon Valley culture piece-by-piece, which can help you understand how investors and entrepreneurs think.

Alex Tew, the founder of Calm (billion-dollar meditation app) and one of the first people ever to go viral on the internet with his Million Dollar Homepage. He is a perfect example of a founder that VCs love: scrappy, independent-minded, a natural marketer with a great story, and willing to work on ideas that others consider crazy.

Here’s the full story: