What business school teaches you about startups

Introducing MBA 80/20, a new perk for Silicon Valley Outsider subscribers

After four years in consulting, the Partners send you out to pasture — that is, to business school. And even though leaving the firm is mandatory, they still ask you to present a “business case” explaining why they should pay for your tuition. I told the Partners what they wanted to hear — that I was coming back, and that I wanted to improve my “business fundamentals.”

But that was bullshit. (Sorry, consulting friends!)

I went to business school to learn how to start a startup.

And it was one of the best decisions of my life.

🌉 For two years straight, I spent every waking hour learning about startups and venture capital.

I started two companies in business school: one that raised $500,000, and another that was acquired. I interned at two venture capital firms, mentored a founder whose company just crossed $1 million in monthly recurring revenue, and paid for my tuition by writing whitepapers for a think tank. I was the President of LAUNCH, UC Berkeley’s startup accelerator, and ran the Haas Venture Fellowship.

I also spent time book-learning: I read every startup book I could find, attended Berkeley’s top graduate and undergraduate classes on entrepreneurship, and won a half-ride scholarship for making an “extraordinary and lasting contribution to the entrepreneurship program.”

I left no stone unturned.

⭐ And now, I want to share with you everything that business school taught me about startups.

But I’m going to save you a lot of time, and even more money. You don’t have to spend every hour for two years or pay $100,000 in tuition— you just have to subscribe to Silicon Valley Outsider.

Because today, I’m starting a new series as a perk to my paid subscribers.

I will post a short overview for each topic publicly, and a longer, more comprehensive post for subscribers only. Subscribers also get exclusive perks:

A video lecture from me along with each lesson

Workbooks to help you understand venture math, startup metrics, and more

Detailed book reviews to save you time reading (and uncover some hidden gems that I’ve never posted about publicly)

And, most importantly, subscribers get a kickstart for their Silicon Valley networks. I’ll have my friends — the investors, founders, and operators some of the world’s fastest-growing companies — give guest lectures, and it’s precisely those sorts of introductions that have helped my career immeasurably over the years.

In short, subscribers will get my personal attention: I’ll help you make the transition to Silicon Valley and the world of startups.

👋 That’s all for now… for most of you!

Subscribers: let’s chat. Your first MBA 80/20 video, and your first Subscriber-exclusive story, is after the jump.

👋 Howdy folks! Thank you for subscribing.

If you’re reading this, I want to hear from you. Please email me at christian@pronouncedkyle.com so we can get to know each other!

You can find your first MBA 80/20 video below, but first, a story.

This story starts when I was in business school, and — to be honest — floundering. I had an insane amount of energy, all of which was dedicated to learning about startups, but I had no idea where to point it when I first arrived on campus.

So, I did as any uncreative overachiever would, and signed up to run a bunch of existing clubs and initiatives on campus. One of those clubs was the “VC Speaker Series,” a weekly lecture series where the organizer would invite a venture capital investor to come speak to a group of MBA students.

And if I’m being honest, signing up to run the VC Speaker Series really felt like a mistake.

It was a time-consuming, and thankless, chore. I would reach out to dozens of people, get a couple of replies, and then work logistics: making sure they knew where to park, when to arrive, and how to set up the A/V.

Don’t get me wrong, these speakers were amazing people. One in particular stood out at the time: Larsen Jensen, a man with the most star-studded resume I’ve ever seen: Olympic silver medalist; Navy SEAL; Stanford Business School; Andreessen Horowitz; Lightspeed Ventures.

But, refreshingly, he was just a normal dude. He talked about the struggles that plague successful people, and assured us that sexy resume bullets aren’t a recipe for fulfillment. I’ll never forget the way that he respectfully, but incredibly forcefully, answered a rude question that went something like, “so, what’s it like having everything be easy for you?” He assured the questioner that things aren’t always what they appear on the outside (while staring the dude down), and that student got pretty quiet for the rest of the night.

Once his Q&A was over, Larsen left Berkeley within a few minutes and I figured that would be my last encounter with the guy. My small talk never really went anywhere, which was par for the course. And I assumed that would be the end of the story.

Flash forward one year, and I’m helping Astranis build out our government business.

Well, to be precise, I’m just a random finance guy at Astranis about three months into his new job, and I’ve just heard a rumor that Astranis is thinking about entering the government business.

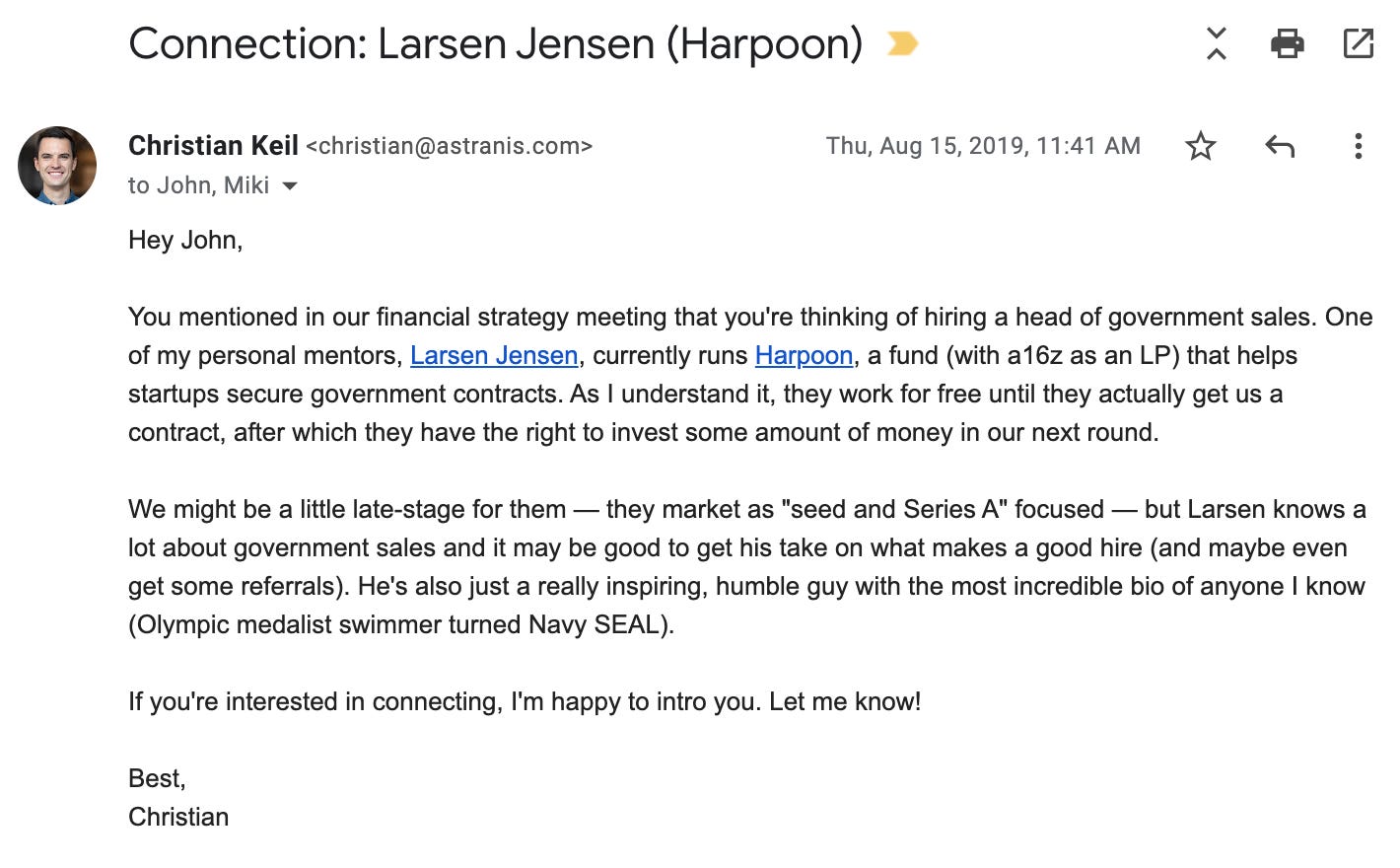

And then it hits me: wait… isn’t Larsen doing something with VC and defense? I hit up LinkedIn to confirm, then shot my shot, sending an unprompted email to our CEO:

John said yes, I introduced him to Larsen, and the rest is history:

Harpoon ended up investing a significant amount of money into Astranis, and became one of our most value-additive investors.

There are three morals to this story.

First, the obvious one: just make connections. You don’t have to know how they will end up helping you in the future, or even if they will. Your goal should be to genuinely provide value to people that you want to be a part of your network (more on this in my “Power and Politics” lecture later!), and the rest will take care of itself. (In this case, I genuinely did Larsen a solid by intro-ing him to Astranis; I have to imagine we are among his best investments.)

Second, move to Silicon Valley. The density of people who love startups and investing out here is unrivaled. Sure, you can find pockets of people who do startup stuff in other cities, but here, startups are everywhere. All of the billboards on the highway are for startups; everyone you randomly meet at the bar or at your Tuesday kickball league has a disproportionately high chance of having a cool job at a startup. Just move here. Do it!

But third, and this lesson will bear repeating over and over again: the startup world moves incredibly quickly, but the long-term game is the one you want to win. I thought the speaker series was useless because I didn’t get any immediate reward out of it. But I was wrong! Super wrong.

My connections proved to be important, as the story shows, and so did the skills that I perfected while running it: setting up presentations, asking good questions, working logistics, and getting important people to reply to cold emails.

So, don’t be afraid to play the long game. It might be that your first, second, or third attempts don’t play out as you expect — but if you’re a genuinely nice, helpful person, your long-term relationships will help you over the long haul.

And now, without further ado: your first lesson of MBA 80/20: Silicon Valley Startups.

I hope you enjoy it!